UBS Downgrades Rivian Stock: Why Expectations May Be Too High

UBS cuts Rivian to Sell, raises target to $15, and warns that investor expectations around AI and the R2 launch may be too optimistic.

UBS cuts Rivian to Sell, raises target to $15, and warns that investor expectations around AI and the R2 launch may be too optimistic.

Wolfe Research cuts Rivian to Underperform with a $16 target, citing weaker fundamentals, higher losses, and growing downside risks.

Lucid Group reports Q4 2025 deliveries of 5,345 vehicles, surpassing estimates as new Gravity SUV helps offset expired tax credits and weakening demand for premium EVs.

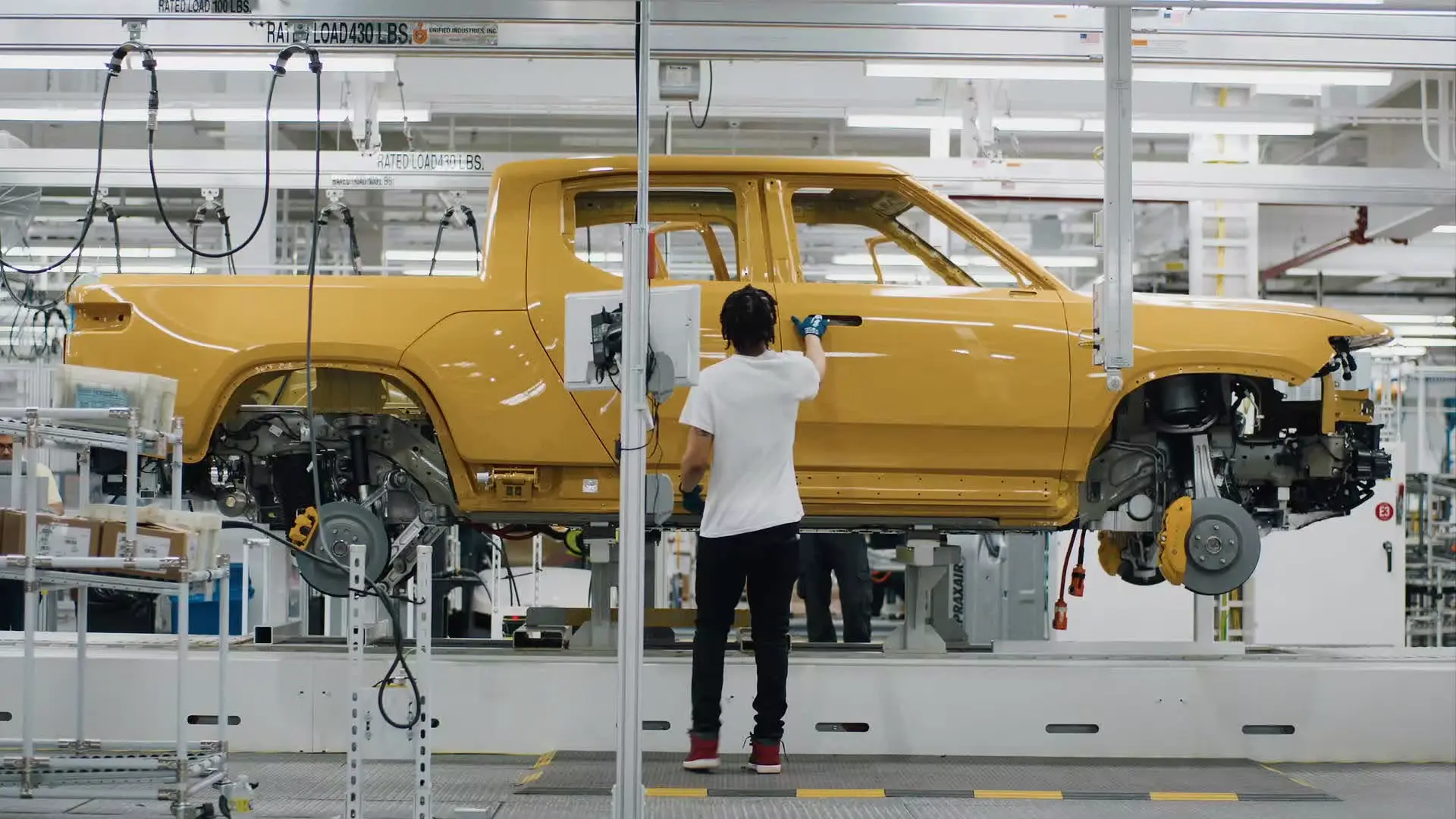

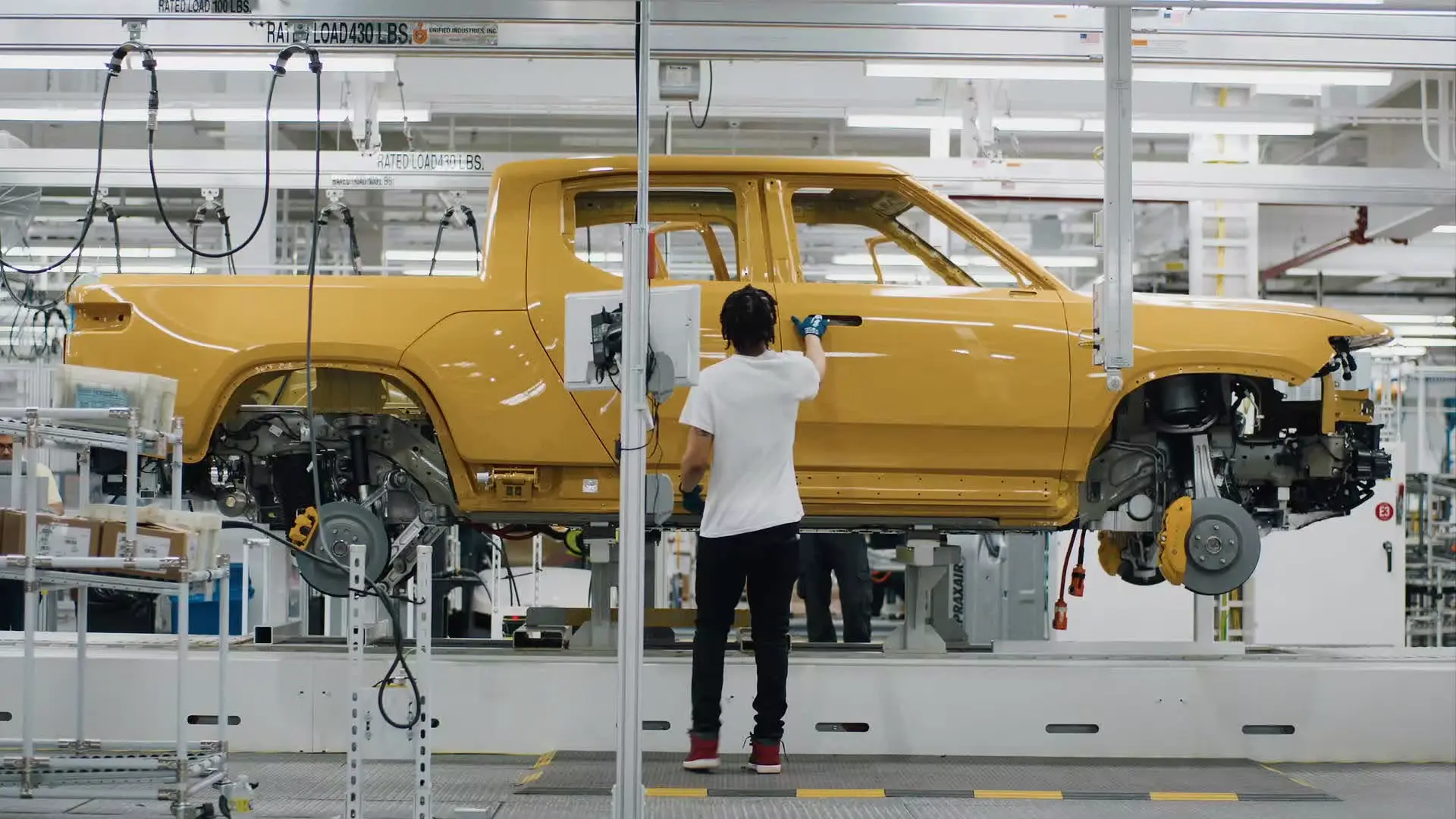

Rivian delivered 42,247 EVs in 2025, down 18% year-over-year, missing analyst expectations as the company prepares to launch its affordable R2 SUV in 2026.

Baird upgrades Rivian stock to Outperform, raises its price target to $25, and highlights the R2 launch and autonomy progress as key growth drivers.

Rivian shares surge to nearly 2-year high as analysts praise custom autonomous driving chip and affordable AI features, positioning company as potential #2 EV player in North America.