Samsung to Supply Nvidia with Next-Gen HBM4 Chips: What It Means for the Memory Market

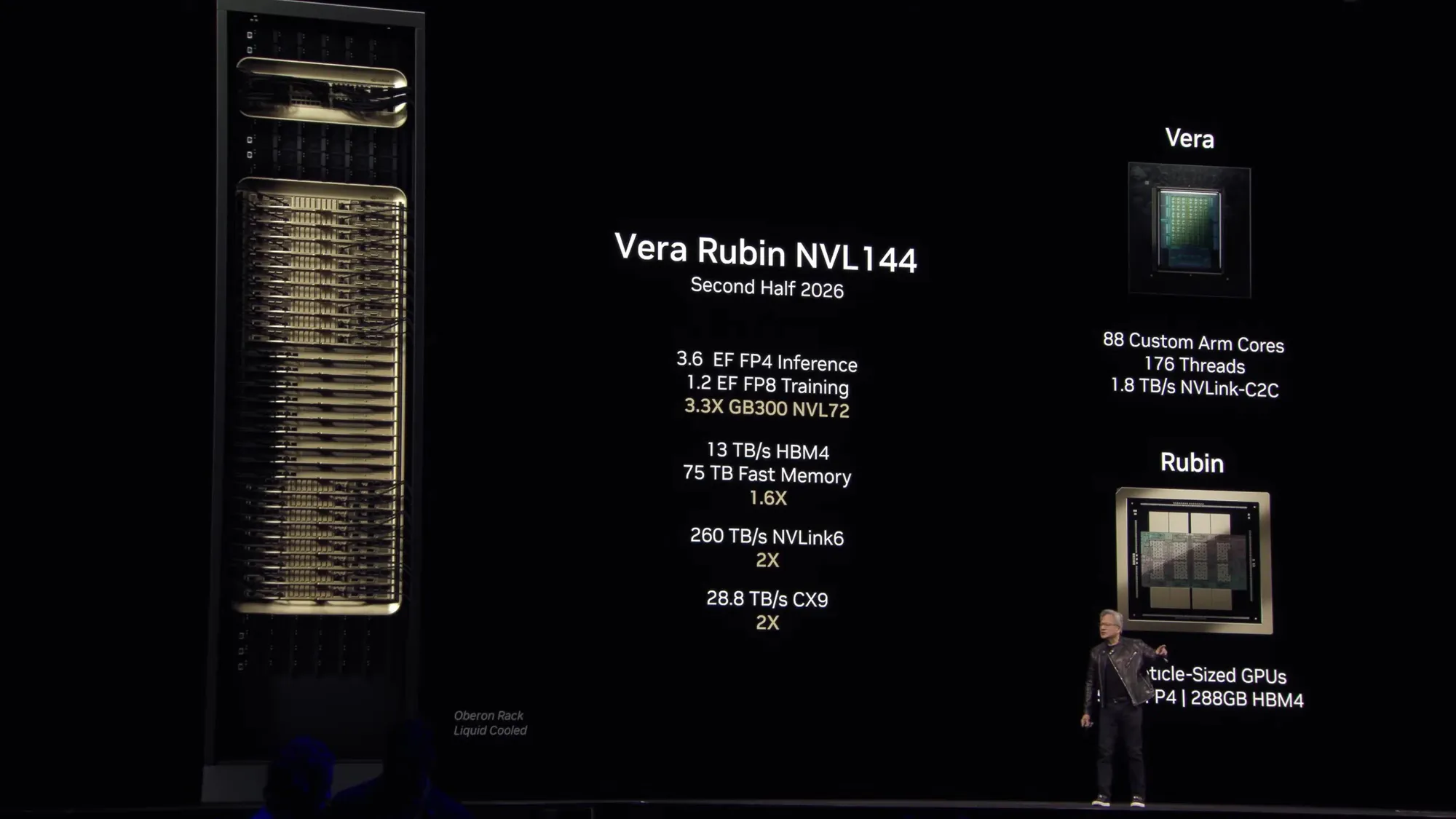

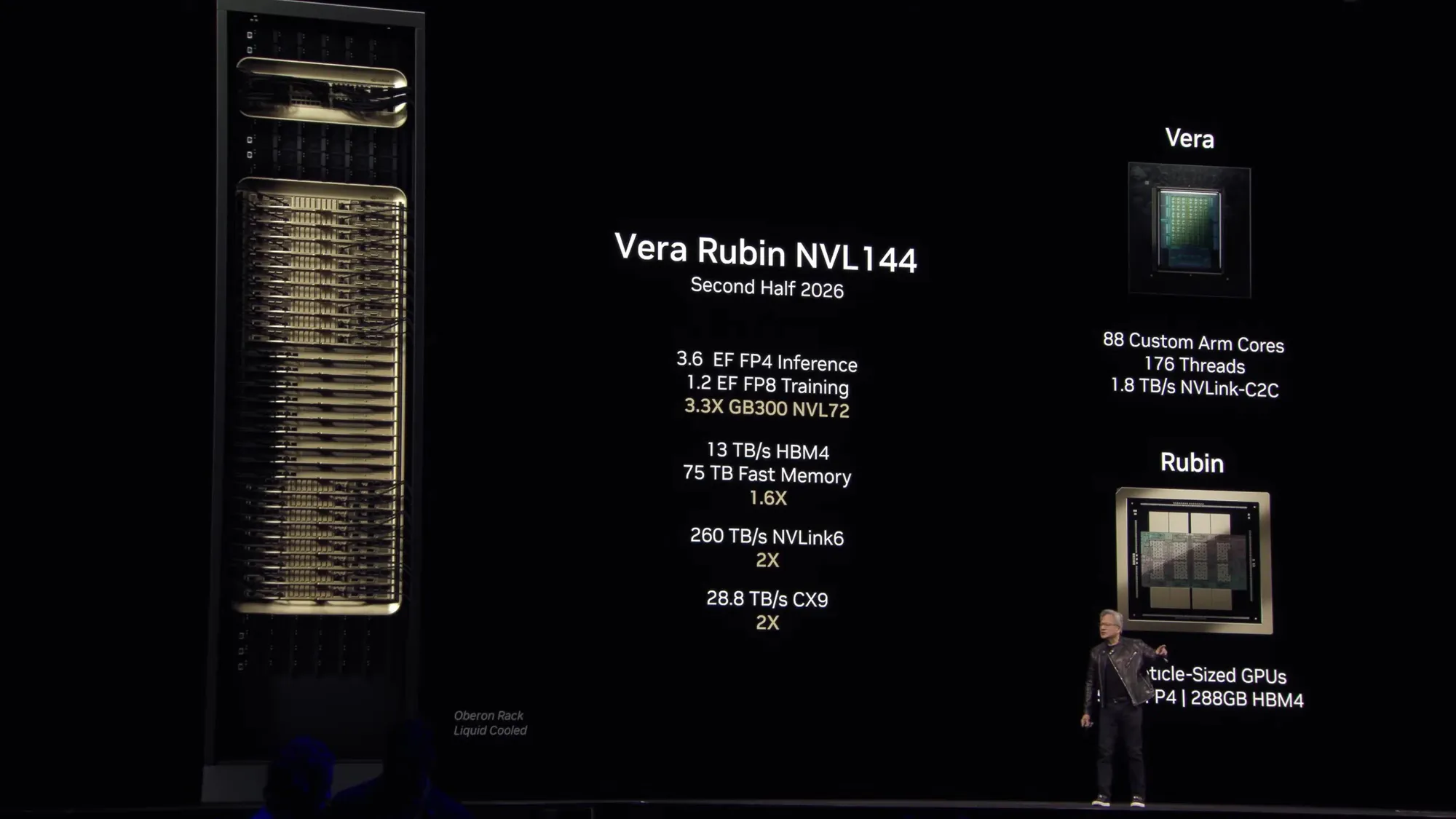

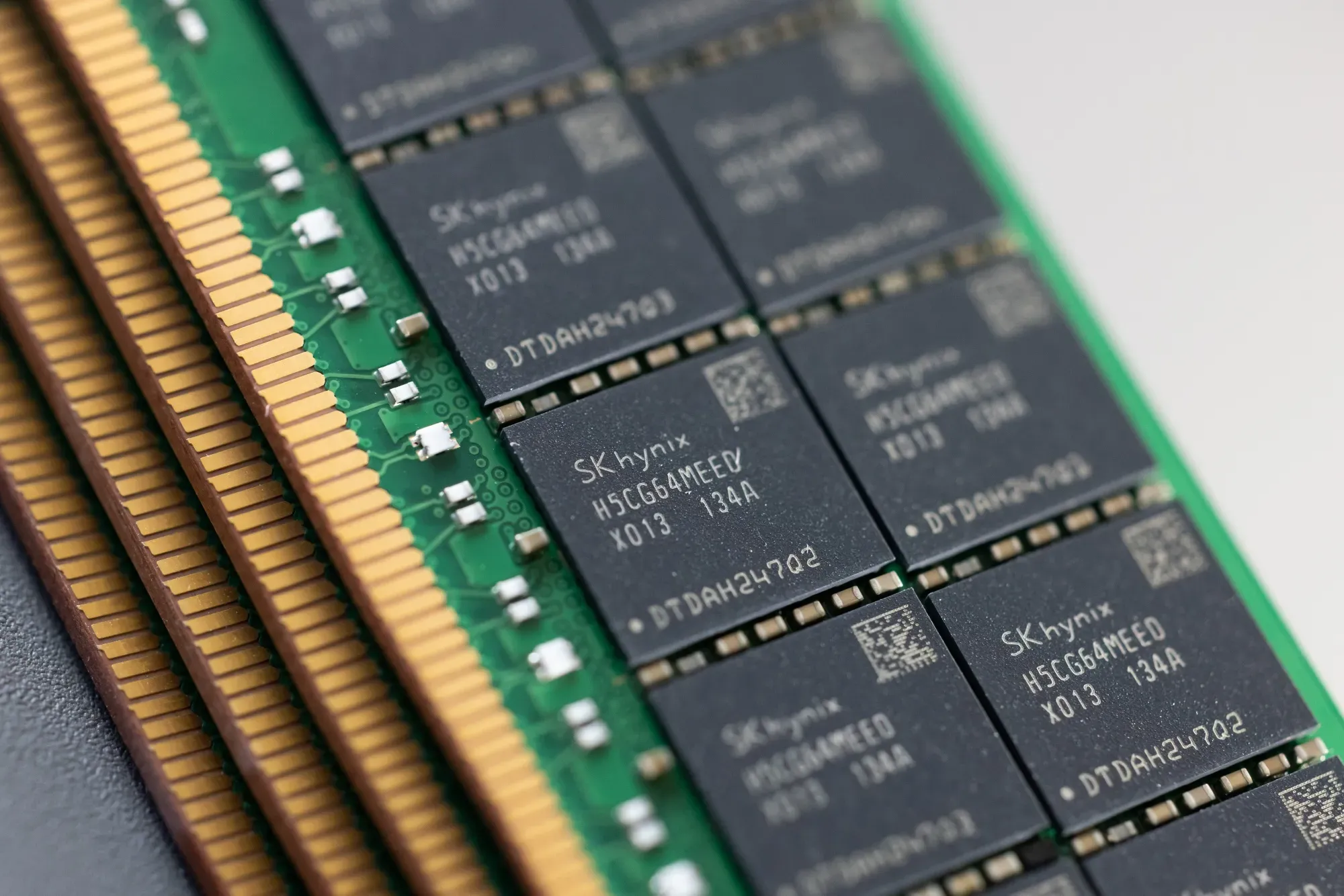

Samsung Electronics will begin producing HBM4 memory chips for Nvidia next month, intensifying competition with Micron and SK Hynix in the booming AI chip market.

Samsung Electronics will begin producing HBM4 memory chips for Nvidia next month, intensifying competition with Micron and SK Hynix in the booming AI chip market.

Micron Technology reports an accelerating memory chip shortage through 2026 as AI infrastructure demand surges. The company invests $1.8B in Taiwan expansion while building $100B US production site.

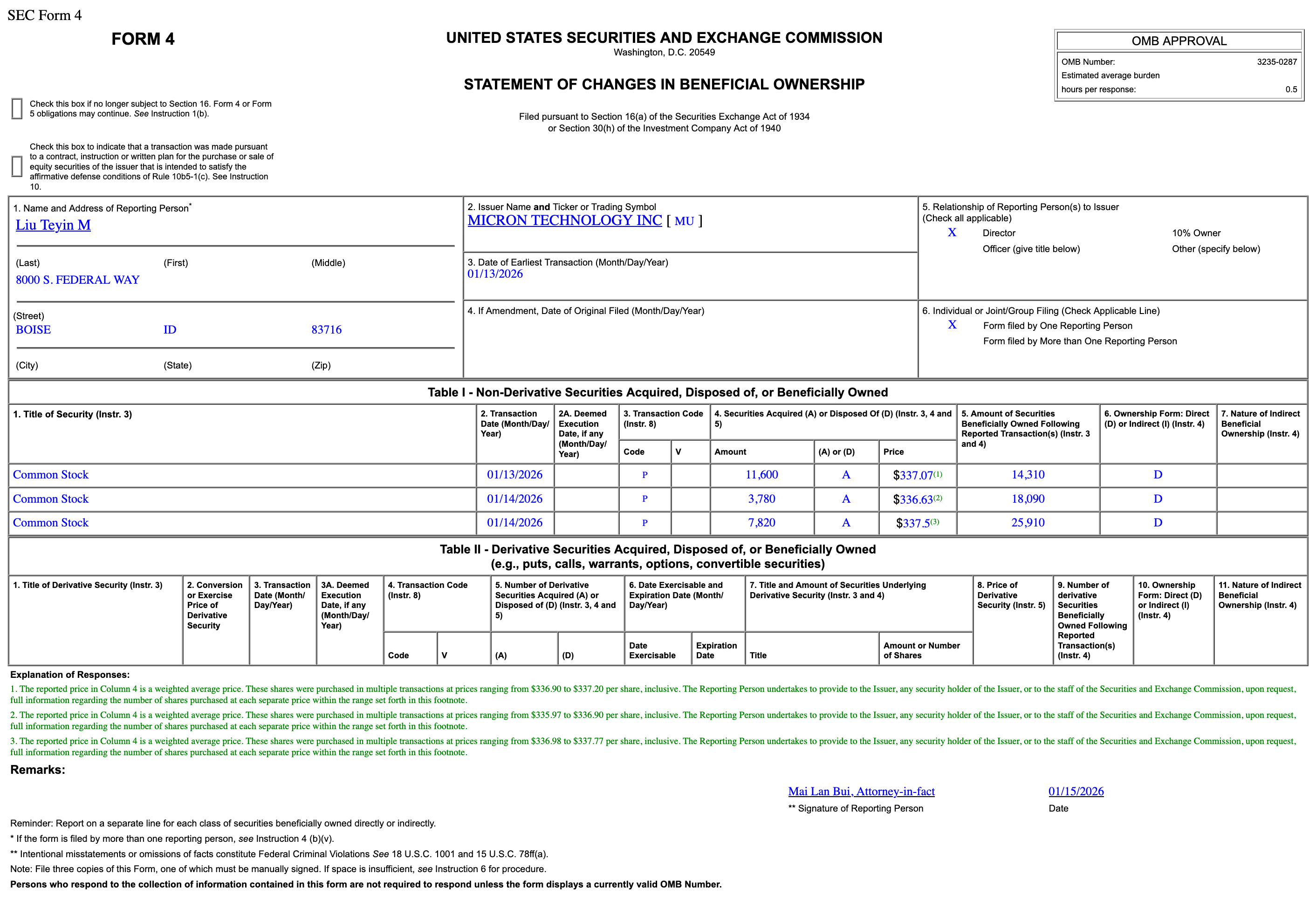

Micron shares rise premarket after director Teyin Liu buys $7.8M worth of stock, signaling confidence as chip stocks rally.

TSMC announces massive $56B spending plan for 2026, signaling confidence in AI boom. Strong earnings and expansion plans boost tech sector optimism.

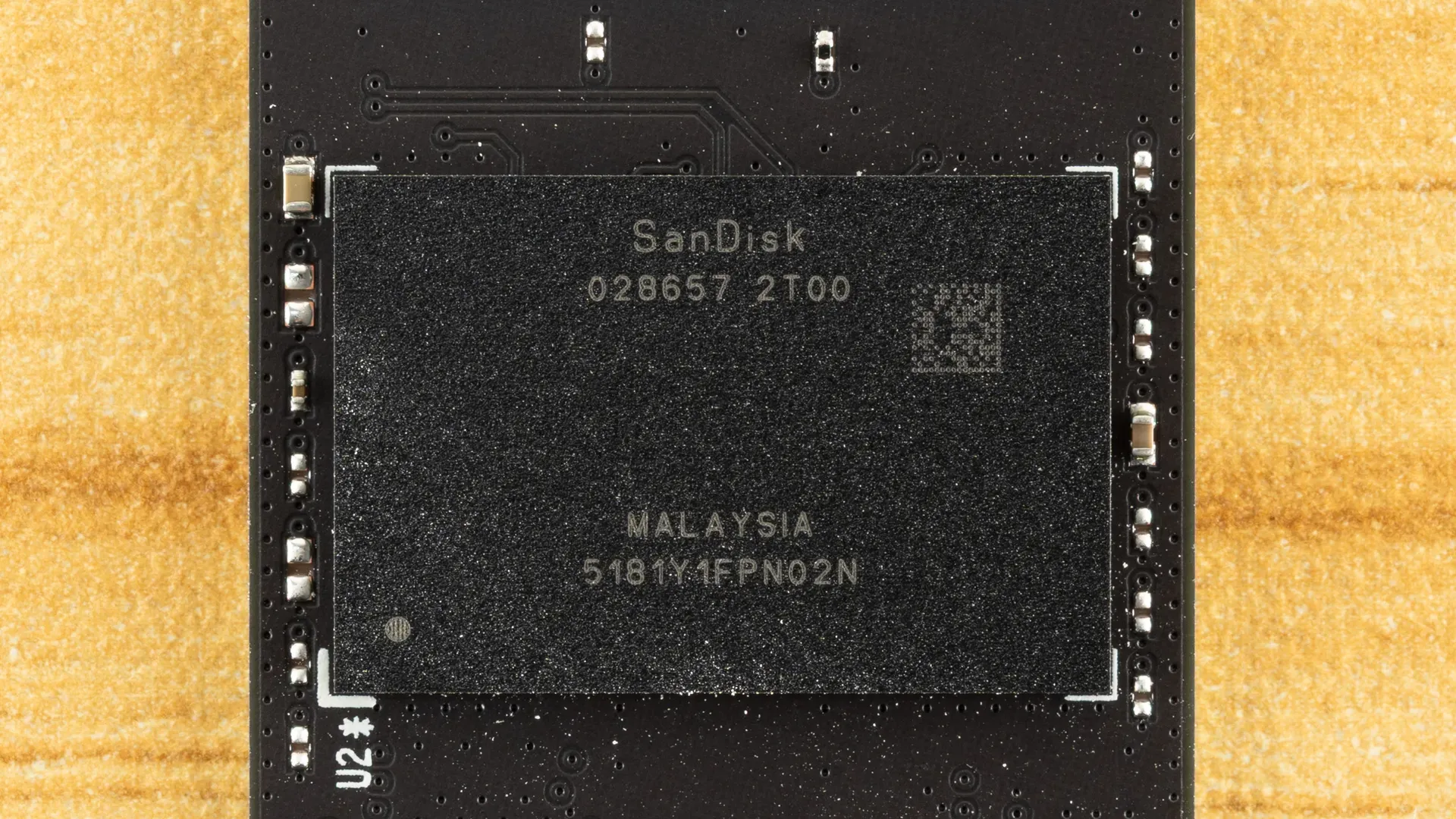

SanDisk plans to double prices for high-capacity 3D NAND memory in Q1 2026 as AI infrastructure drives unprecedented demand for enterprise storage solutions.

Samsung, SK Hynix, and Micron raise HBM3E memory chip prices by 20% as demand surges from AI chipmakers, defying typical pre-launch price drops.