Amazon's Grocery Push Sends Kroger, Instacart, and Delivery Stocks Tumbling

Amazon's expanded grocery delivery plans and 100+ new Whole Foods stores trigger stock drops for Kroger, Instacart, Uber, DoorDash, and Walmart as competition intensifies.

Amazon's expanded grocery delivery plans and 100+ new Whole Foods stores trigger stock drops for Kroger, Instacart, Uber, DoorDash, and Walmart as competition intensifies.

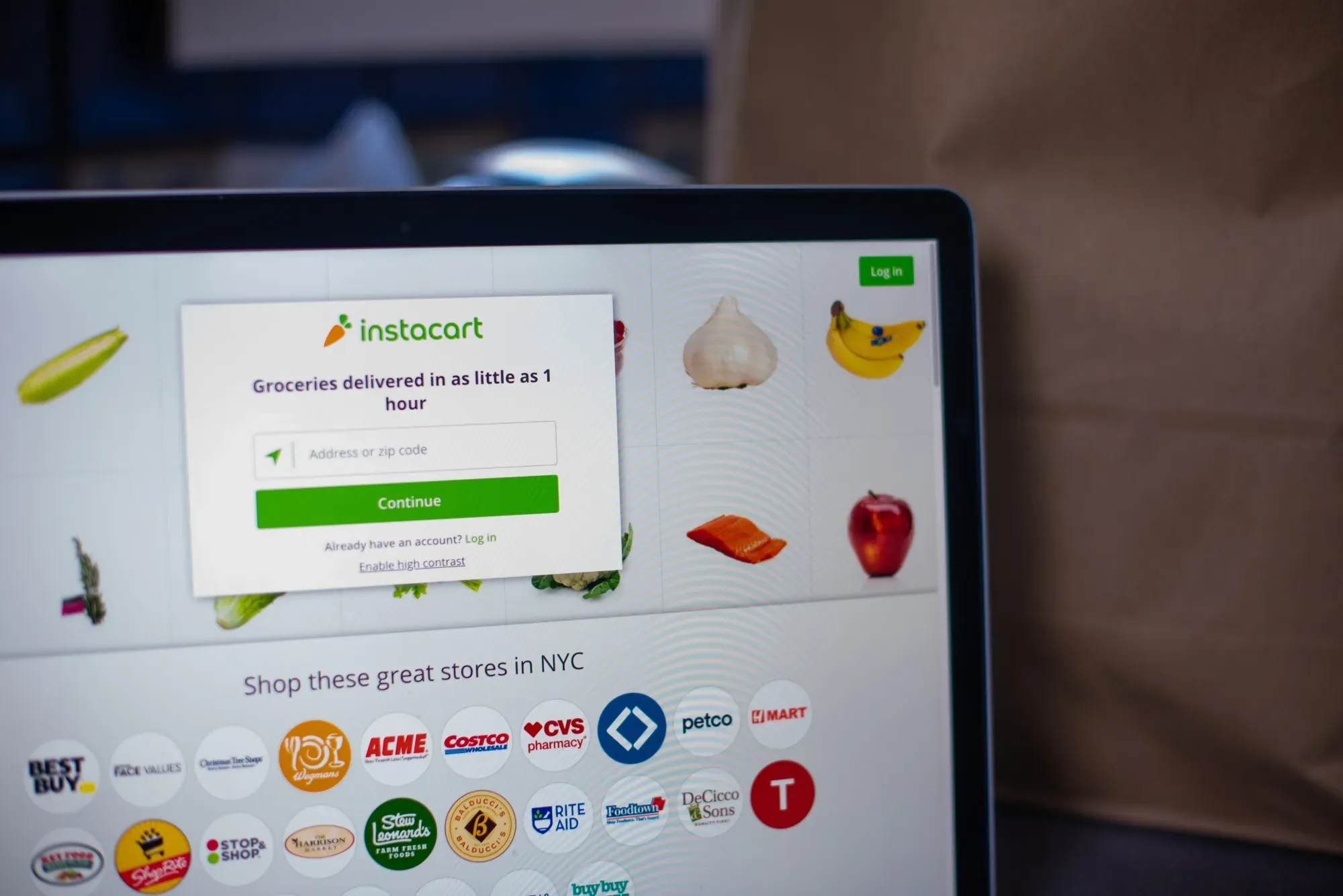

Amazon's Same-Day Delivery service now offers fresh groceries in over 2,300 U.S. cities, challenging Instacart and Walmart+ with fast, temperature-controlled delivery for Prime members.

Kroger cuts 2025 sales outlook to 2.8-3% growth as budget-conscious shoppers trade down and competitors slash prices. Stock falls 7% despite beating profit expectations.

Amazon plans ultrafast 30-minute grocery delivery service in major U.S. cities, causing Instacart stock to drop 4% as competition intensifies in the delivery market.

Jefferies upgrades DoorDash to Buy with a new $260 price target, citing stronger growth, underappreciated execution, and improved long-term flexibility.

Serve Robotics CEO Ali Kashani believes ads on its autonomous delivery robots could one day cover full operational costs, even as Q3 results miss.