AMD and OpenAI Forge Landmark AI Infrastructure Deal, Targeting Tens of Billions in Revenue

Advanced Micro Devices strikes a definitive agreement with OpenAI to supply 6 gigawatts of GPUs, challenging Nvidia's dominance and granting OpenAI warrants for up to a 10% stake in the chipmaker.

Advanced Micro Devices (AMD) and OpenAI have signed a definitive agreement for the deployment of vast artificial intelligence (AI) infrastructure, a pact that AMD executives project could generate "tens of billions" of dollars in new revenue. Following the announcement, AMD’s shares surged, jumping over 24% to reach $205 in early trading.

The partnership solidifies AMD as a core strategic partner to the ChatGPT creator. Under the terms of the deal, OpenAI is committed to deploying 6 gigawatts (GW) of AMD GPUs over multiple years. This massive buildout will begin with an initial 1-gigawatt rollout scheduled for the second half of 2026, featuring AMD’s forthcoming Instinct MI450 chips. OpenAI intends to use these AMD chips specifically for inference functions—the computations needed for AI applications like chatbots to quickly respond to user queries.

For AMD, this agreement represents its biggest victory yet in its strategic quest to challenge Nvidia's overwhelming dominance in the AI accelerator market. While AMD remains a distant second to Nvidia in the market for these "accelerator chips," the tie-up with OpenAI is viewed as transformative for industry dynamics. AMD Chief Financial Officer Jean Hu stated that the partnership is expected to "deliver tens of billions of dollars in revenue" and will boost the company’s earnings per share. AMD executives believe that the subsequent ripple effect of this agreement will provide a springboard to greater technology adoption, potentially pushing revenue from this area (OpenAI and other customers) above $100 billion.

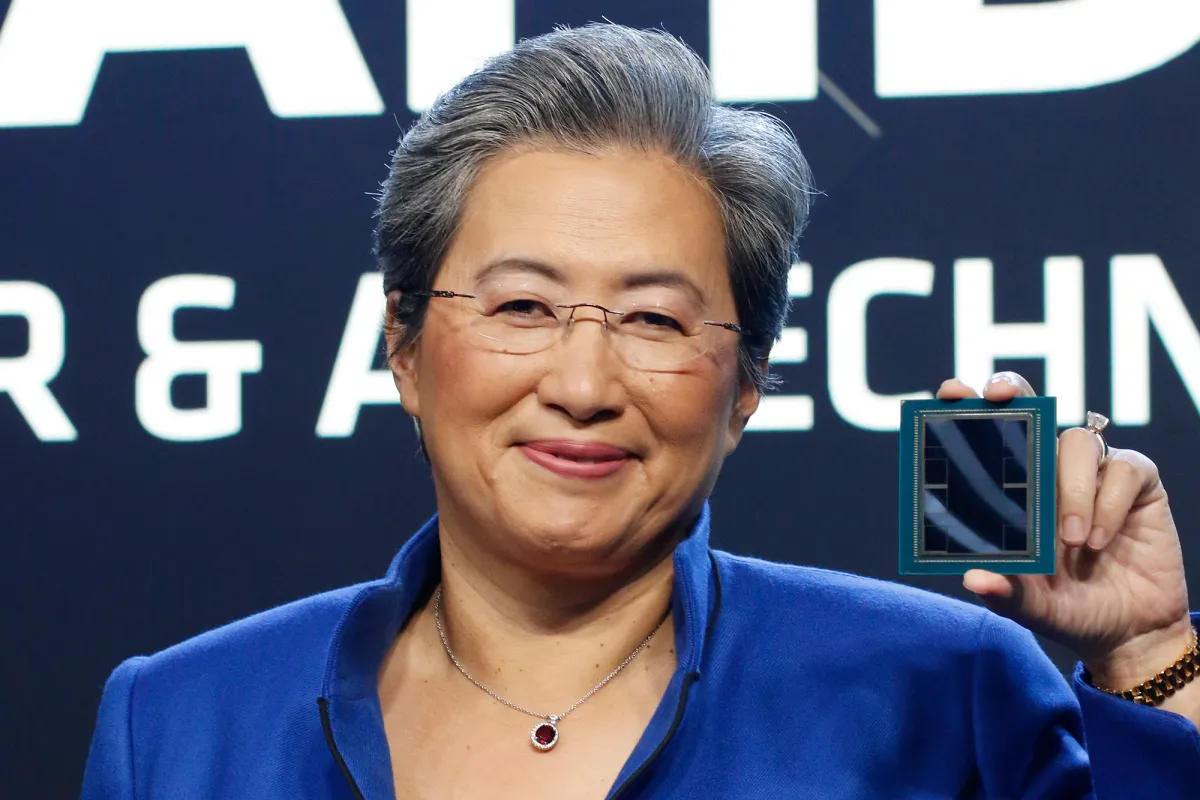

Central to the strategic alignment is a warrant granted by AMD to OpenAI, allowing the AI company to buy up to 160 million shares (approximately 10% of AMD's common stock) for 1 cent each. The vesting of these warrants is carefully tied to significant milestones. The first tranche vests upon the deployment of the first gigawatt of computing power. Additional portions vest as further hardware is put in place, alongside the achievement of specific AMD share-price targets that escalate up to $600 per share for the final installment. AMD CEO Lisa Su noted that she is glad that OpenAI’s incentives are tied to AMD’s success, and vice versa.

For OpenAI, led by CEO Sam Altman, this commitment is described as a "major step in building the compute capacity needed to realize AI’s full potential". The startup has been on an aggressive dealmaking spree to secure data center capacity, driven by soaring demand for inference computing. This deal contributes 6 GW to OpenAI's broader infrastructure roadmap and helps foster a more robust alternative to Nvidia’s ubiquity. This infrastructure commitment follows OpenAI’s earlier investment arrangement with Nvidia (up to 10 GW) and a $300 billion megadeal with Oracle (4.5 GW), signaling the unprecedented, continuous expansion required to satisfy the explosive demand for AI services. OpenAI’s president, Greg Brockman, emphasized the existential nature of this drive, stating he is "far more worried about us failing because of too little compute than too much".