Wall Street Loves Klarna: Why Six Big Banks Are Betting on BNPL

Top banks rated Klarna (BNPL leader) highly, seeing massive growth in payments. They target $48–$58, noting it trades at a healthy discount.

- Positive Ratings Flood In: Several major investment firms, including Citi, Goldman Sachs, Deutsche Bank, JPMorgan, UBS, and Wolfe Research, recently initiated coverage of Klarna (KLAR) with highly positive ratings such as Buy, Overweight, and Outperform.

- Global BNPL Leader: Klarna is recognized as the market leader and largest global player in the "Buy Now Pay Later" (BNPL) sector. The company holds a strong franchise, particularly in Europe.

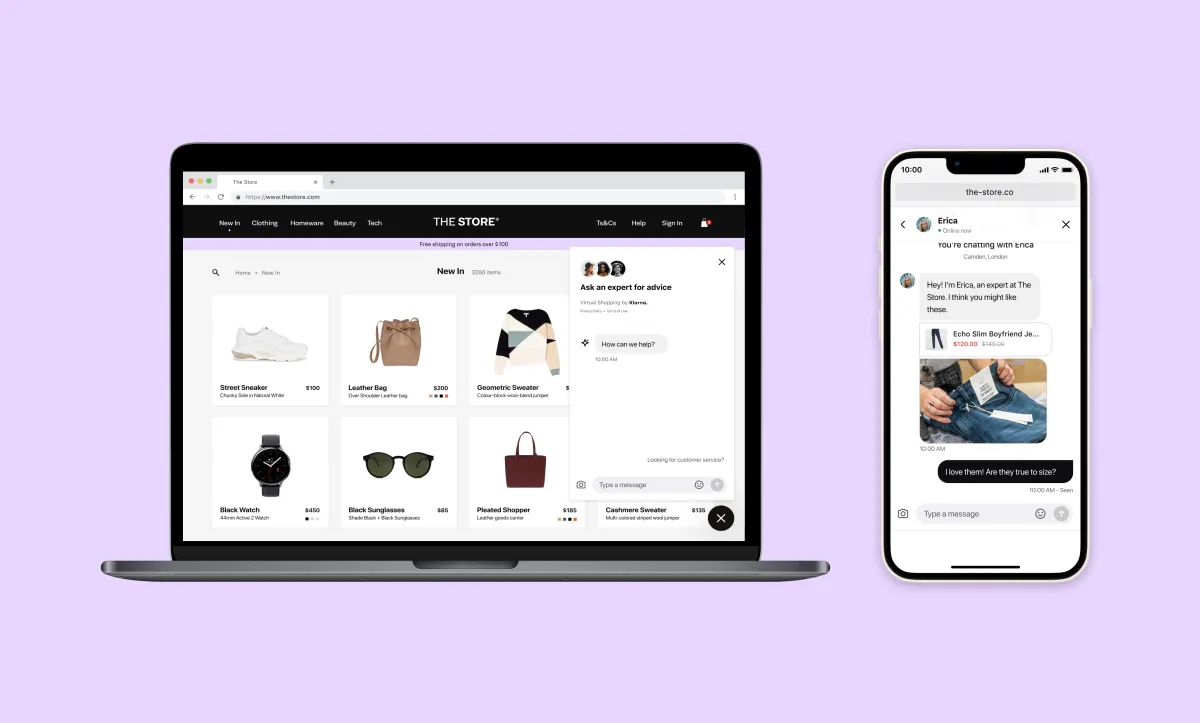

- Targeting Massive Growth: Analysts are positive on Klarna due to its exposure to the "untapped, fast-growing" BNPL market. The firm aims to become the preferred method for consumers to pay for everything.

- Key Growth Strategies:

- Klarna is working to gain more market share over time.

- The company is actively expanding in the United States.

- It is shifting toward more profitable, longer duration loans.

- Future growth is expected from rolling out the debit-led Klarna card.

- Powerful Partnerships: Klarna is well-positioned for continued growth thanks to strategic partnerships with major players like JPMorgan, Worldpay, Apple, and Google.

- Fintech Powerhouse: Klarna is described as a "fintech pioneer" that has developed into an "international financing and commerce powerhouse". Its system is compared to a closed-loop payment scheme, similar to American Express in the U.S..

- Attractive Entry Point: Investment firms suggest the shares offer an attractive entry point. JPMorgan noted that Klarna currently trades at a "healthy discount" compared to its primary competitor, Affirm (AFRM).

- High Price Targets: The price targets set by these firms range from $48 to $58 per share. Citi, for instance, projects Klarna’s transaction margins will move higher by fiscal 2026.