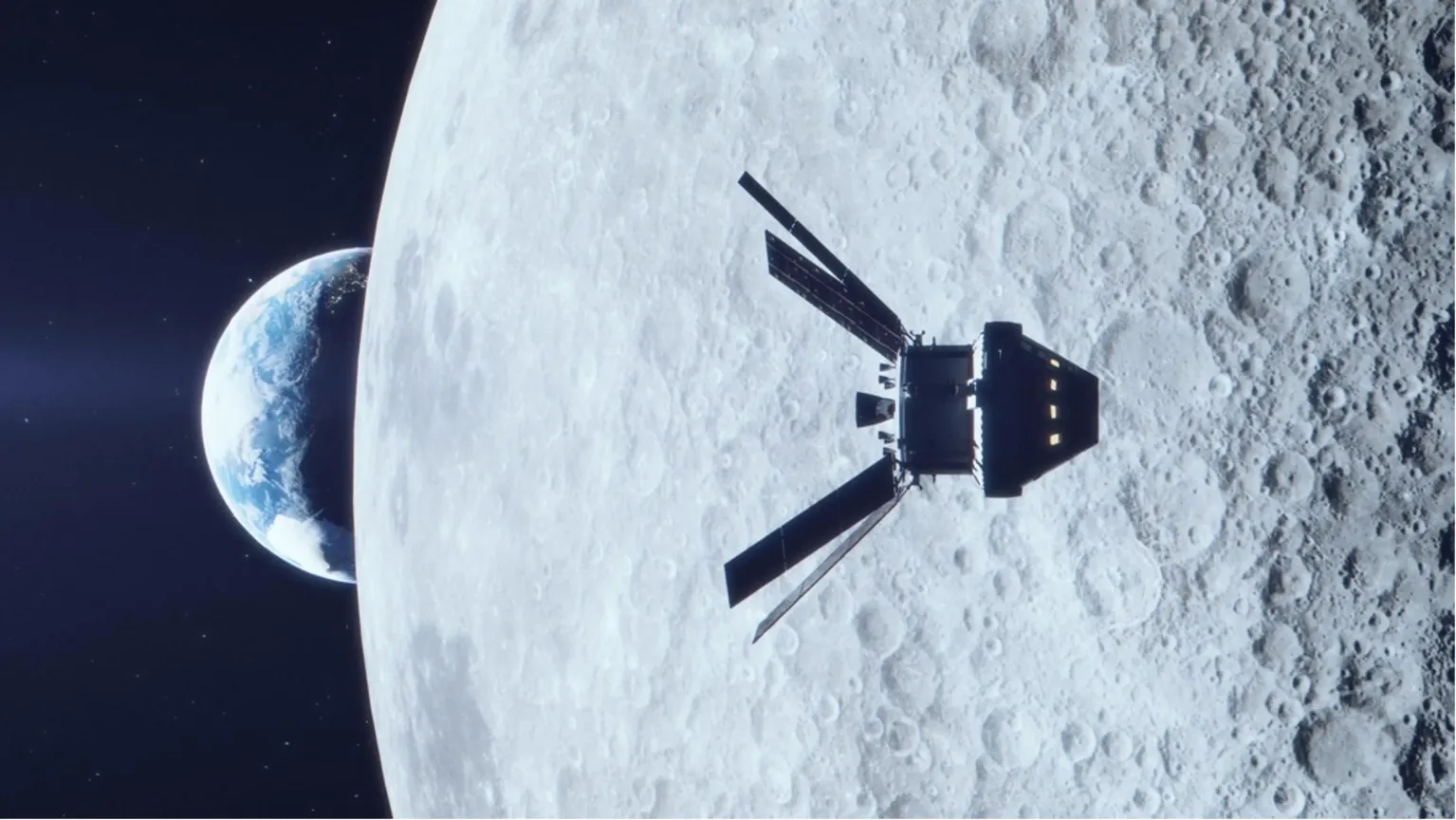

AST SpaceMobile Gets a Big Boost from Barclays after Bluebird Update

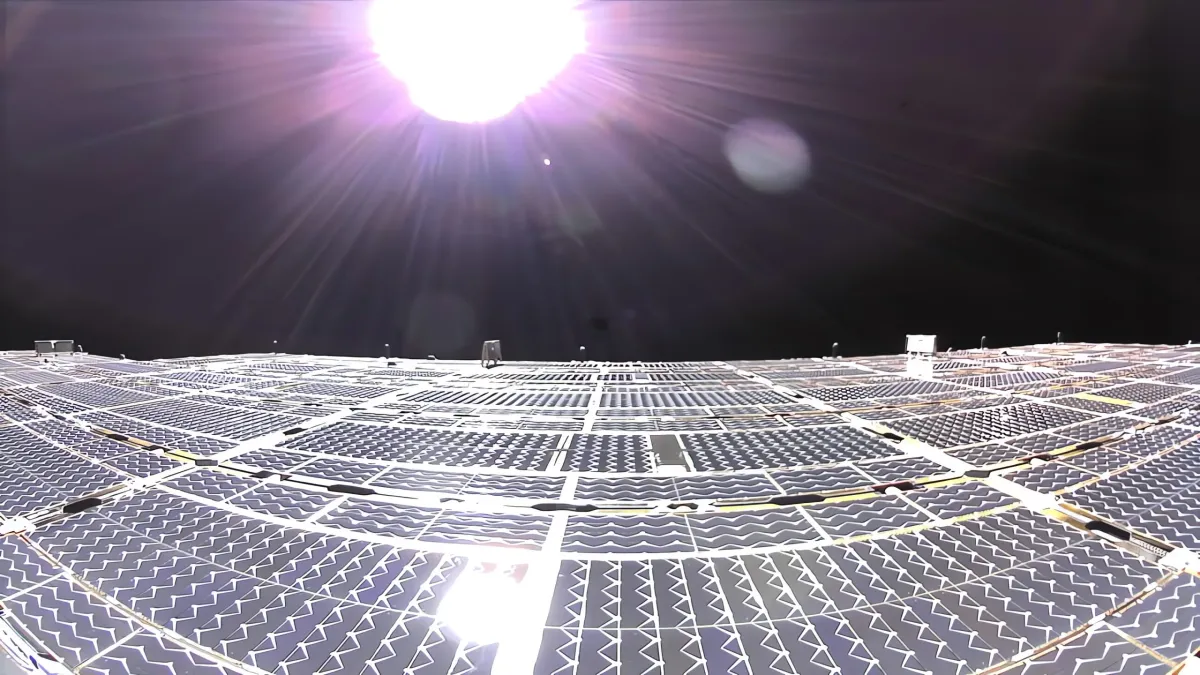

Barclays hiked the AST SpaceMobile stock target to $60 (from $37) because the long-term future looks better, even with minor delays. AST's richer broadband/call/text products mean they can charge more than rivals' basic text-only plans.

Already have an account? Sign in.